Get a tax card as a non-Danish employee

The tax card helps you pay the right tax on your Danish salary. If you don’t have a tax card, you will pay 55% in taxes on your salary.

We will send your tax card directly to your employer who will deduct your tax and transfer it directly to the Tax Agency and then pay you your salary.

Have you worked or lived in Denmark before?

You only need to get a personal tax number (CPR no.) once as you will use the same tax number whenever you are in Denmark.

If you have worked or lived in Denmark before, you already have a personal tax number (CPR no.). If you can’t find it, we will find it for you when we generate your tax card.

Don’t apply for your tax card until 1 month before you start your job

We can’t generate your tax card and/or personal tax number until 1 month before you start your job in Denmark.

Are you a non-Danish student?

If you have come to Denmark to study, you can read more at Coming to study.

A tax card (skattekort) is a digital piece of information telling your employer your tax rate.

You can see your tax card by logging on to skat.dk/tastselv and select ‘Forskudsopgørelsen’ (Tax budget).

You only need to have your personal tax number (CPR no.) issued once. The reason is that you will use the same personal tax number whenever you are in Denmark.

If you don’t have a personal tax number yet, we will generate it at the same time as we generate your digital tax card (skattekort). If you can’t recall your personal tax number, we will find it for you when we generate your tax card.

Once we have generated your tax card, you can see your personal tax number (CPR no.) in your tax budget (forskudsopgørelse). We will send your personal tax number to your employer via Digital Post.

Your personal tax number is your unique ID number

It consists of 10 digits. The first 6 digits are your date of birth (day, month and year) while the last 4 digits are random. Example: 010185-1234

All Danish authorities, banks and employers use your personal tax number (CPR no.) to identify you.

Getting a tax card via E-tax (our self-service system - TastSelv)

If you use skat.dk/tastselv to get your tax card, it will typically be generated right away. You can use skat.dk/tastselv, if you meet the below 3 requirements:

1. You live in Denmark and have a health insurance card with your CPR no.

2. You are registered with a Danish address before you start your job.

3. You have MitID or an E-tax password (TastSelv-kode).

In some cases, the Tax Agency needs to approve your tax card after you have entered your information. If that is the case, it will take up to 5 days.

Getting a tax card via our digital form

If you apply for a tax card via our digital form, it will take about 2 weeks. If you also need a personal tax number, we will generate one for you at the same time.

This is the process:

- You find the required documents.

- You complete the digital form and attach the relevant documents.

- We process the form and your documents.

- If you have sent us all the required information, we will generate your digital tax card (skattekort) and possibly a personal tax number (CPR no.)

- We will send your personal tax number to your employer and let your employer know when your digital tax card is available.

- If you have entered your email address in the form, we will send you an email when we have generated your tax card and a possible personal tax number.

You can generate your tax card yourself via skat.dk/tastselv or you can complete the digital form 04.063 and then we will generate it for you.

You can generate your tax card in E-tax (our self-service system - TastSelv) if you meet the below 3 requirements:

- You live in Denmark and have a health insurance card stating your CPR no.

- You are registered with a Danish address before you start your job.

- You have MitID or an E-tax password (TastSelv-kode).

When you generate your own tax card via skat.dk/tastselv, you have to state your expected salary for the rest of the year.

This is what you do:

- Log on at skat.dk/tastselv

- Select ‘Forskudsopgørelsen’ (Tax budget)

- Select ‘Nyt job’ (New job)

- Go to ‘Lønindkomst mv’ (Earned income etc.) and enter your expected salary before tax (gross salary) for the rest of the year

- Select ‘Indkomst og betalt skat indtil ændring’ (Income and tax paid until change)

- Select your first working day under ‘Skattekort gyldigt fra (dag og måned)’ (Tax card valid from (day and month)

- Select ‘Beregn’ (Calculate)

- Select ‘Godkend’ (Accept)

- Log off at skat.dk

You have now generated your tax card. Your employer will be informed automatically, so there is nothing more for you to do.

You need a photo or a pdf of these documents before you can use the digital form:

Employment contract or confirmation of employment

- All pages of your contract or confirmation of employment in one file.

- The document must be signed by you and your employer.

Passport or national ID card

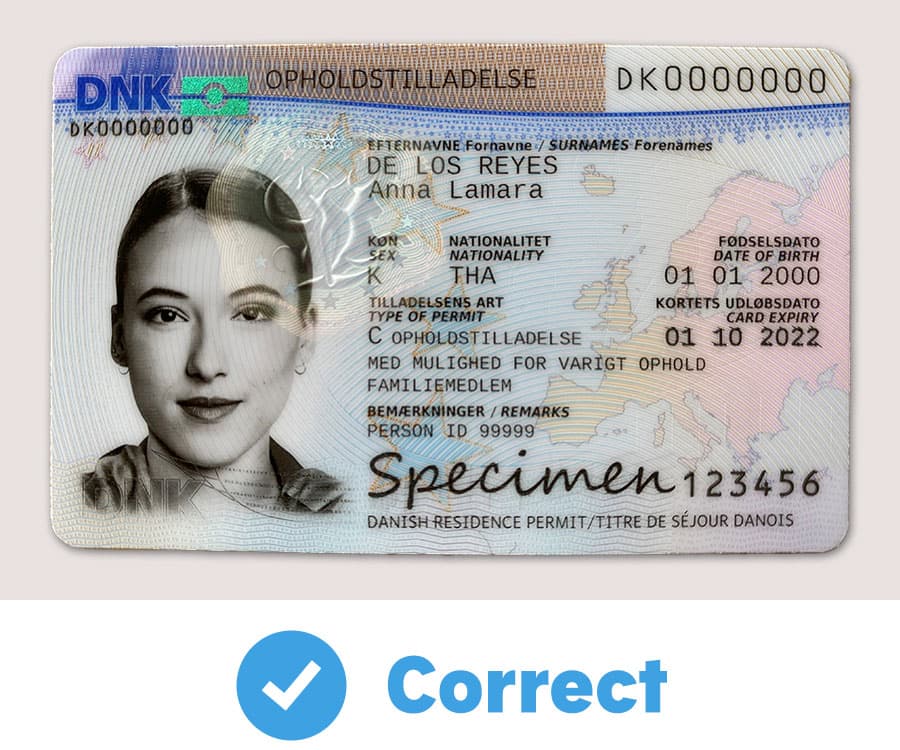

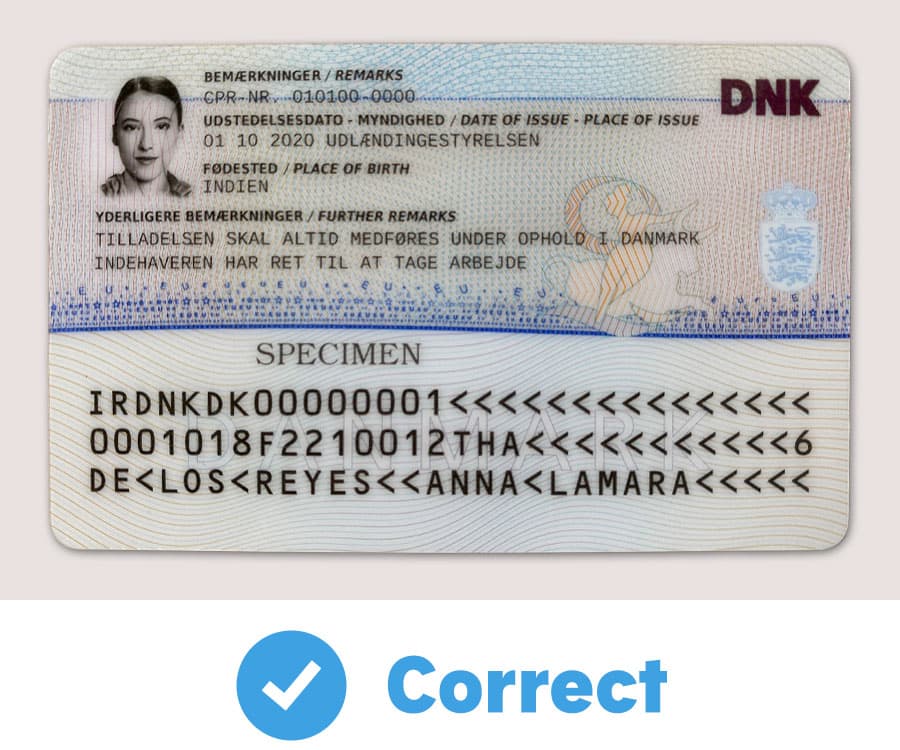

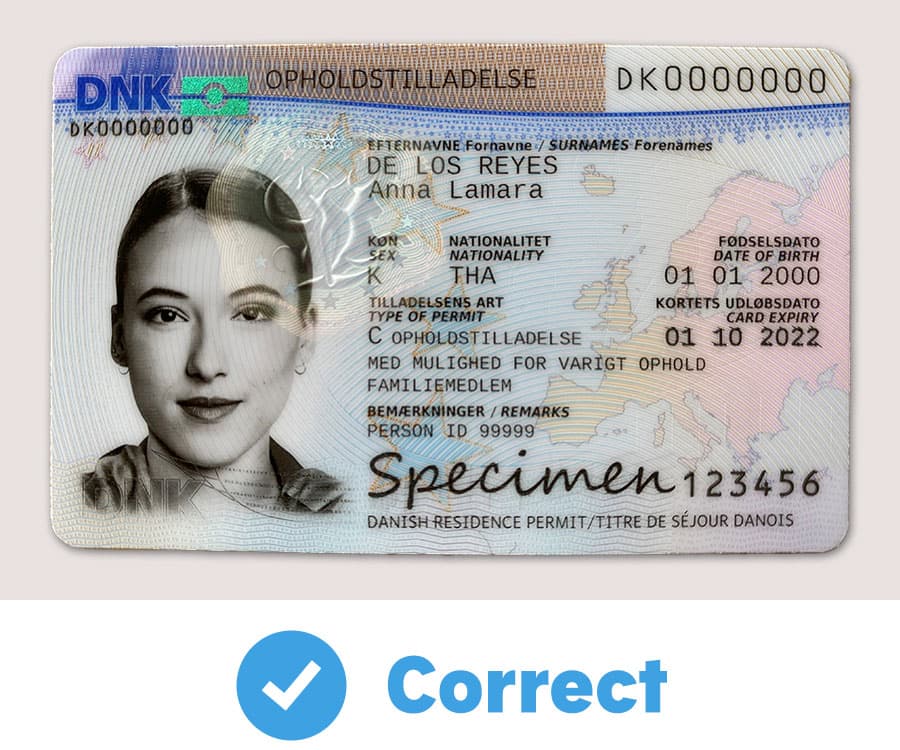

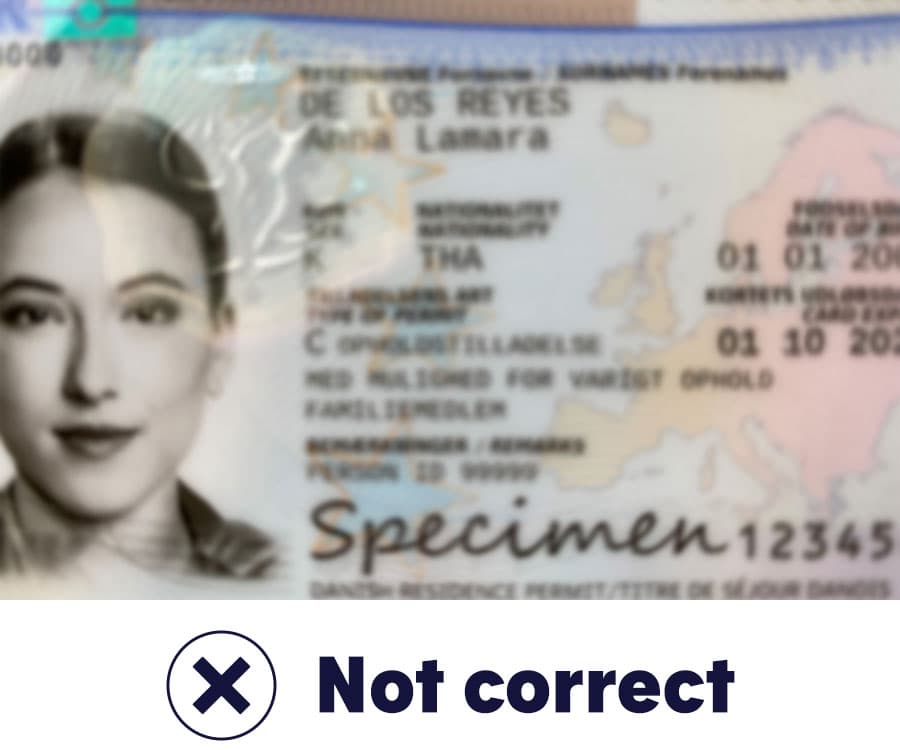

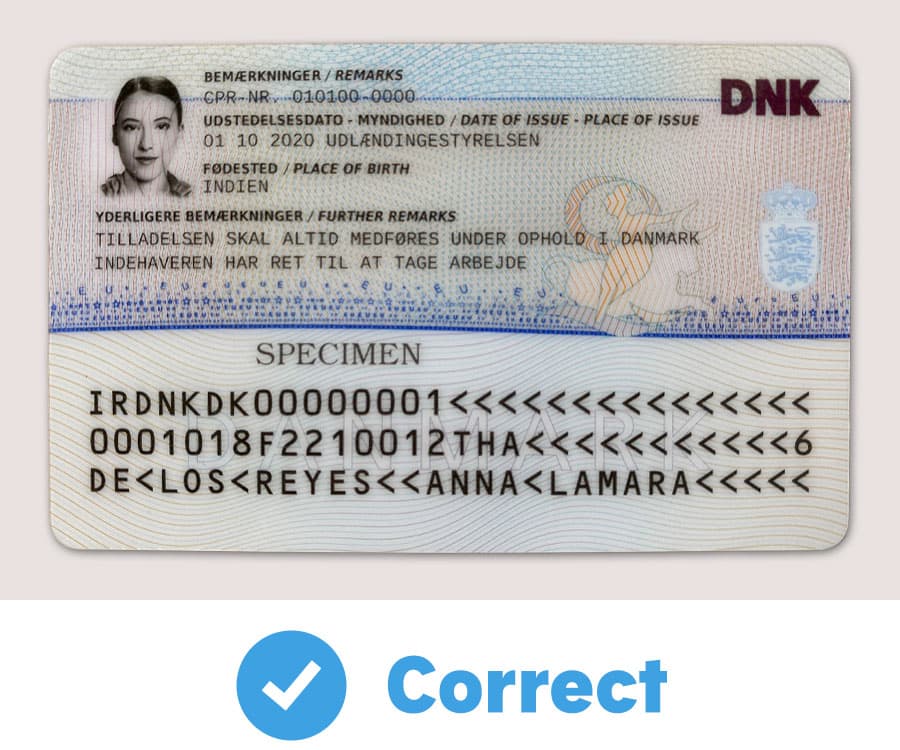

- A photo of the page in your passport with all your personal information or a photo of the front and the back of your national ID card.

- Your ID card must be issued by a public authority.

- The card must state your name, date and place of birth, gender, citizenship and expiry date.

- The photo or copy should be legible, in colour and show the entire document.

Marriage certificate if you are married

- All pages of your marriage certificate in the original language.

For citizens of a country outside the EU, Norway, Iceland, Switzerland or Lichtenstein

- Your Danish residence and work permit

If you live in Sweden and you need a Danish tax card, you have to complete our digital form 04.063 and then we will generate your tax card.

You need a photo or a pdf of following documents before you can use the digital form:

Employment contract or confirmation of employment

- All pages of your contract or confirmation of employment in one file.

- The document must be signed by you and your employer.

Passport or personal certificate and national ID card

- A photo of the page in your passport with all your personal information

or

- a photo of your personal certificate as well as the front and back of your ‘nationellt id-kort ‘ (national ID card). Please note that you can’t use your Swedish driving license as ID card.

The photo or copy should be legible, in colour and show the entire document.

If you are married

- A copy of your ‘familjebevis’ (family certificate).

For citizens of a country outside the EU, Norway, Iceland, Switzerland or Lichtenstein

- A copy of your Danish residence and work permit as your Swedish residence permit is not accepted in Denmark.

You can ask your employer to help you get a tax card. You can apply for one by logging on to skat.dk/tastselv or you can complete our digital form.

How to get a tax card via skat.dk/tastselv

When you generate your own tax card via skat.dk/tastselv, you have to state your expected salary for the rest of the year.

This is what you do:

- Log on at skat.dk/tastselv

- Select ‘Forskudsopgørelsen’ (Tax budget)

- Select ‘Nyt job’ (New job)

- Go to ‘Lønindkomst mv’ (Earned income etc.) and enter your expected salary before tax (gross salary) for the rest of the year

- Select ‘Indkomst og betalt skat indtil ændring’ (Income and tax paid until change)

- Select your first working day under ‘Skattekort gyldigt fra (dag og måneed)’ (Tax card valid from (day and month)

- Select ‘Beregn’ (Calculate)

- Select ‘Godkend’ (Accept)

- Log off at skat.dk

You have now generated your tax card. Your employer will be informed automatically, so there is nothing else to do.

Getting a tax card via our digital form

You need a photo or a pdf of these documents before you can use the digital form:

Employment contract or confirmation of employment

- All pages of your contract or confirmation of employment in one file.

- The document must be signed by you and your employer.

Marriage certificate if you are married

- All pages of your marriage certificate in the original language.

Residence permit

- Your Danish residence and work permit.

You will get a tax card and a personal tax number (CPR no.) by completing our digital form. You can ask your employer to help you.

You need a photo or a pdf of these documents before you can use the digital form:

Employment contract or confirmation of employment

- All pages of your contract or confirmation of employment in one file.

- The document must be signed by you and your employer.

Passport or national ID card

- A photo of the page in your passport with all your personal information or a photo of the front and the back of your national ID card.

- You ID card must be issued by a public authority.

- The card must state your name, date and place of birth, gender, citizenship and expiry date.

- The photo or copy should be legible, in colour and show the entire document.

Marriage certificate if you are married

- All pages of your marriage certificate in the original language.

Residence permit

- A receipt from Udlændingestyrelsen (the Danish Immigration Service) that 1) you have applied for a residence permit and 2) have had your finger prints and photo (biometrics) taken for your residence permit.

Please also read our guide for Ukrainians about job and tax in Denmark

You should check if you are entitled to one or more deductions while you work in Denmark. Such deductions could include personal allowance, deduction for food and accommodation or deduction for transport between home and work.

You can authorise a representative such as an advisor or your employer to see and enter your information in E-tax (our self-service system TastSelv). Read more at Allow third party access to E-tax.

You may also give a representative a power of attorney if you want this person to represent you in matters with the Tax Agency. Please complete form 02.043 (General power of attorney).

For further legal information in Danish see our legal guide .